This article is part of a 4-part Crypto Native series titled The Infinite Fund where we dismantle the legacy logic of venture capital and explore what’s replacing it. In Part 1, we break down the structural failure of the 10-year fund cycle, a model that forces premature exits, misaligns incentives, and consistently leaves long-term value unrealized. Sequoia recognized this and, in 2021, replaced its traditional structure with a permanent capital vehicle designed to hold positions longer and capture the compounding value that often emerges after a company goes public.

In Part 2, we reframe volatility as a productive input rather than a risk to avoid, exploring how Digital Asset Treasuries like MSTR and SBET are turning volatility into yield. In Part 3, we introduce programmable capital and the rise of capital composers, intelligent allocators that operate through onchain signals and evolving models rather than slide decks and scheduled meetings. Part 4 imagines a fully composable financial future where every asset, fund share, and treasury becomes liquid and coordinated by intelligent agents.

At Nautilus Asset Management, we are building toward that future today. Our proprietary transformer model, Seneca, is trained on market structure rather than language, and is already generating Sharpe ratios between 1.5 and 1.7 across volatile environments. Seneca is core to our long-term growth, and the Infinite Fund is not a concept we are waiting for. It is a protocol we are already running. If you are still clinging to outdated fund mechanics, this is your signal to evolve or be left behind.

The Web3 shift isn’t coming. It’s already here. Make smarter moves with curated strategies from Nautilus.Finance. Follow Tom Serres on X.com or LinkedIn for real-time insights and opportunities.

Timebox Theater: How the Fund Cycle Killed the Plot

Let’s be honest: the 10-year venture fund was never designed for composable protocols or real-time liquidity. It was built for a slower, simpler era, when raising capital meant 48 slides, a handshake at Buck’s, and an IPO a decade later that everyone toasted like a wedding. It was institutional theater. And for a while, it worked.

But time caught up with the structure. Today’s best investments don’t peak at exit, they compound afterward. The liquidity curve has shifted. The startup is no longer a straight line from Seed to Series D to a final liquidity event. Value creation happens across messy, dynamic timelines. Yet most funds are still operating like it’s 2005, with a playbook built to wrap up just as the real compounding begins.

Sequoia saw this problem clearly. In 2021, they became a Registered Investment Adviser and restructured their business into a permanent capital structure: the Sequoia Fund. By removing the 10-year clock and gaining flexibility over asset composition, they positioned themselves to hold through the public phase, where the majority of returns often accrue. They now manage over $45 billion in public equities, no longer forced to distribute stock just as it gets interesting, and allow LPs to redeem annually, providing liquidity without sacrificing upside. This wasn’t a marketing stunt. It was a signal that the legacy fund structure is obsolete.

We experimented with this model at the Tomorrow Fund in 2019. It was a chance to explore a rolling structure, learn from the unique insights that the Sequoia Fund created, and take into consideration a future driven by intelligent agents and the ability to recycle and compound value. That thinking, once unconventional, is now showing up everywhere. Digital Asset Treasuries are emerging as a dominant structure, increasingly resembling the original vision: always-on, signal-responsive, and unburdened by artificial exit pressure.

At Nautilus, we’ve taken those learnings and built something smarter: Seneca, our proprietary transformer model trained not on founder charisma or pitch decks, but on market structure, volatility regimes, and multi-dimensional signals. It doesn’t meet quarterly. It doesn’t chase hype. It allocates based on what’s real. Seneca is already producing early Sharpe ratios between 1.5 and 1.7 in live environments, composing capital with a level of precision and adaptability that’s impossible in human hands.

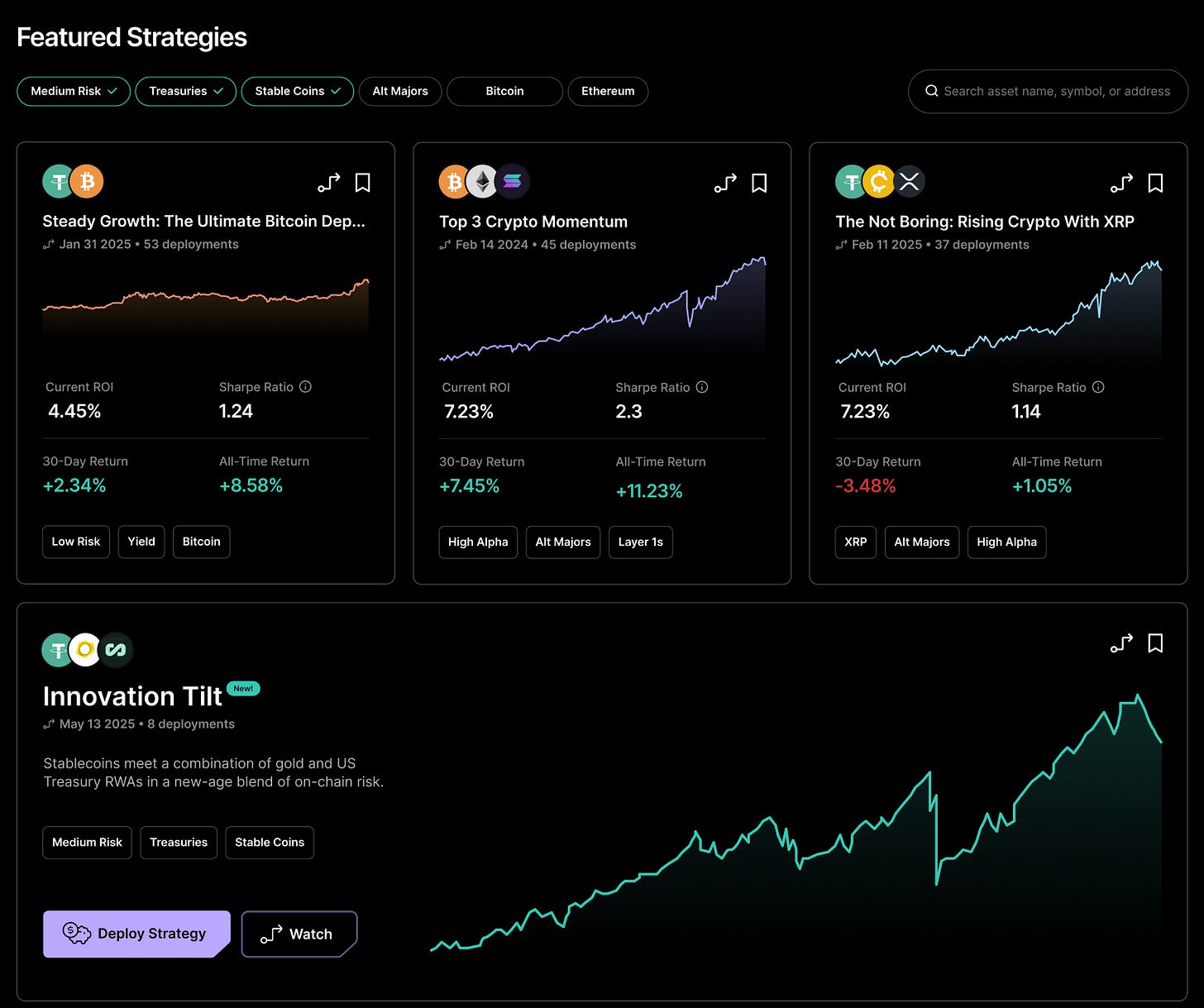

You can see this model in action in the Nautilus dashboard, where strategies are visualized, allocated, and adjusted in real time based on evolving signal strength. We’ve embedded a video below to give you a glimpse of what composable conviction actually looks like on-screen.

Meanwhile, most of the industry is still clinging to fund mechanics optimized for that former KPMG guy who thinks LP updates are a one-man theater production. It’s boardroom cosplay. The only thing it compounds is ego.

That’s what we’re replacing. Not just the timeline, but the entire operating logic of venture. The Infinite Fund is a new model: structurally unconstrained, signal-driven, and built to hold. We don’t wait for exits. We grow conviction. And we let it compound.

Seneca: Our Transformer Doesn't Speak, It Trades

Seneca isn’t a fund. It’s a custom-built transformer model designed by Nautilus to do one thing extremely well: interpret time series data and generate capital allocation signals with surgical precision. Inspired by the architecture that powers models like GPT-4 and Claude, Seneca replaces language prediction with market prediction, transforming how capital responds to volatility.

At its core is a multi-headed self-attention mechanism, the same architecture that made LLMs commercially viable. But instead of weighing word sequences, Seneca analyzes asset-specific price behavior. It processes dense, high-dimensional representations of time series data, capturing relationships across hundreds of technical, statistical, and structural indicators, far beyond what a human trader could track in parallel. Each token in its sequence isn’t a word. It’s a mathematical feature: volatility windows, momentum shifts, microstructure anomalies. Where a language model builds sentences, Seneca builds strategy.

The model’s attention outputs are aggregated and passed through a stack of feedforward layers with residual connections and layer normalization, optimized to maintain gradient stability while encoding complex temporal dependencies. Position encodings ensure that Seneca understands the sequence and rhythm of financial behavior. This allows it to model entire market states holistically, rather than reactively.

What makes Seneca even more distinctive is how it evolves. We don’t run a single model, we spawn and refine entire lineages. Using a proprietary genetic algorithm, we breed new transformer variants that adapt to specific asset conditions. Each model is evaluated not just on backtested accuracy, but on live statistical fitness, Sharpe, drawdown resilience, hit rate volatility, and more. The fittest survive. The others get culled. No emotion. No bias. Just evolution.

This isn't machine learning as accessory. It’s machine learning as alpha architecture. Seneca doesn’t simulate conviction. It encodes it, directly into the allocation logic. It's our response to the growing complexity and real-time demands of digital asset markets. And it's what makes Nautilus something more than a firm. It makes us a signal-driven operating system for the future of capital.

Explore More From Crypto Native: We Built a Monster. Now We Have to Feed It, A Day in the World of Machine Hustle, The SaaS Funeral Begins With a Whisper, and The Stack You Choose Is the Jurisdiction You Live In.

Sequoia’s Quiet Revolution

In 2021, Sequoia did what most firms were too afraid, or too institutionalized, too golf-club-catered, or too busy calculating IRR voodoo, to even consider. They killed the clock. Quietly, with zero pyrotechnics and no “Thought Leader” LinkedIn threads, they became a Registered Investment Adviser and consolidated all their venture strategies into a single, permanent capital structure: the Sequoia Fund. No vintage years. No arbitrary sunsets. No need to force liquidity just because the calendar says year nine and the LPs are getting fidgety.

They did it because they realized something blindingly obvious that somehow still eludes most of the consultant class: the biggest returns happen after the IPO. Post-public is where the real compounding lives. Not in your quarterly update deck. Not in the markup theater that happens between Series B and Series C. The truth is, in modern venture, exiting at IPO is like leaving the party before the music starts. And Sequoia wanted to stay for the whole set.

This wasn’t just a structural adjustment. It was an act of ideological rebellion against a system that forces you to sell your winners early and pretend that was the plan. The old fund model bakes misalignment right into the crust: GPs who need to close the fund, LPs who want to see distributions on paper, and founders who suddenly have to think about exit velocity instead of product-market fit. Everyone’s faking confidence, while the structure quietly shaves 80% off the upside.

Sequoia called the bluff. By going permanent, they could keep riding Shopify, Snowflake, or whatever the next monster is, not for five years, but for 15. And their LPs? They didn’t panic. Because now they could redeem on their schedule, not the fund’s. One year at a time. A little liquidity, a lot more potential alpha. It’s not revolutionary math, it’s just structure catching up to reality.

What Sequoia unlocked is what we now call the Infinite Fund archetype. A model where capital doesn’t expire on schedule. Where conviction isn’t discounted for the sake of calendar math. And where performance isn’t a puppet show for quarterly PDFs, but a living system that adapts and compounds over decades. You know, the way actual networks grow.

So yes, Sequoia made the first quiet move. And everyone else is still trying to figure out if they’re brave enough, or bored enough, to follow. Because this new archetype doesn’t wear a Patagonia vest or flex fund vintage logos onstage at tech summits. It just keeps buying. Holding. Compounding. Quietly rewriting the rules while everyone else is still rehearsing their IRR lines for the LP talent show.

We Built the Sandbox While Everyone Else Was Polishing PowerPoint

Back in 2019, before “permanent capital” became a podcast talking point and Digital Asset Treasuries had media kits, we were already running the experiment. At Warburg Serres, we launched Tomorrow Fund, a perpetually open, crypto-native capital structure that didn’t conform to traditional timelines or redemption pressure. We didn’t ask what was marketable. We asked what was aligned. And we built it.

We didn’t call it a Digital Asset Treasury. We didn’t pitch it with a market-sizing slide. We just constructed a vehicle that could recycle, reallocate, and compound over time, because that’s what modern capital needs to do. Networks don’t grow in 10-year increments. Liquidity doesn’t obey your fund docs. The Infinite Fund model was already becoming obvious. We just got there early.

Tomorrow Fund wasn’t a theory. It was a working testbed for the structures that are now being mirrored across the industry. Digital Asset Treasuries are no longer fringe experiments, they’re outperforming, trading at premiums in the public markets, and being recognized as structurally superior by investors who finally see the upside of liquidity-aware, always-on capital systems. These aren’t memes. They’re yield machines. And people are paying to get in.

The contrast couldn’t be starker. While emerging capital systems quietly evolve, the ex-consultant guy is still in his eternal theater loop, pitching “diversified growth allocations,” cosplaying as a VC in Patagonia drag, and whispering phrases like “downside protection” to LPs who are mostly just trying to stay out of trouble. He’s optimized for optics. Not outcomes. Still solving for IRR like it’s 1997.

Today, at Nautilus, we’re scaling these ideas through Seneca, a proprietary transformer model that enables Digital Asset Treasuries to enhance yield through intelligent signal generation. Seneca is built to serve as a plug-and-play intelligence layer for any treasury that wants to go beyond static yield farming and into adaptive capital composition. It doesn’t just predict. It allocates. And now it’s available as a service, composable across treasuries, protocols, and real-time execution engines.

This isn’t about being edgy or contrarian. It’s about being aligned with the shape of capital itself. Tomorrow Fund was the sandbox. Now Nautilus is bringing the system online.

The Strategy Doesn’t Pitch, It Performs

Seneca doesn’t need a pitch deck. It doesn’t hold your hand through a three-year roadmap. It doesn’t book dinner with your family office to “deepen the relationship.” It just performs, coldly, continuously, and without apology. Every strategy it spawns is trained, optimized, and unleashed into a digital arena where only the strongest survive. This isn’t fund management. It’s statistical natural selection.

Welcome to the Nautilus Strategy Browser, a live, evolving marketplace of algorithmic intelligence. Think of it as a Darwinian hedge fund, composable and competitive by design. Each strategy is benchmarked not by narrative flair, but by hard performance metrics: Sharpe ratios, drawdown curves, hit rates, and volatility-adjusted returns. If it can’t outperform, it doesn’t get oxygen. There’s no charm offensive here. Just pure statistical edge.

And here’s where things get interesting. These strategies aren’t just individual machines, they’re composable modules in a broader capital orchestration layer. You can stack them, rotate them, or construct multi-strategy portfolios that respond to macro shifts or local volatility regimes. It’s like a hedge fund if hedge funds were protocols, modular, forkable, and on-chain-aware.

This is where combinatorial value kicks in. Want a delta-neutral spread strategy paired with a momentum long-only fund and a macro volatility hedge? You can do that, in seconds. Clients can curate their own “strategy stacks,” dynamically composed based on conviction, risk appetite, or governance mandates. This isn’t asset allocation. It’s capital composition.

And because the entire thing runs in production, any digital asset treasury, DAO, family office, or exchange can integrate it directly into their native UI. It’s not just a SaaS dashboard. It’s hedge-fund-as-a-service, programmable, parameterized, and deployable right alongside their own vault strategies or token governance layers. No cap table dilution. No 2 and 20. Just pure, composable intelligence, wired for yield.

This is what capital coordination looks like when it stops cosplaying as a legacy asset manager and starts operating like software. It doesn’t ask for attention. It attracts liquidity by outsmarting the market, and doing it in real time, with receipts.

Explore More From Crypto Native: The Thermodynamics of Civilization, Agents Ate the App Store, You Are a Citizen of Your Stack, and Not Your Corporate Overlord, Not Your Financial Asset.

Redemption Rights Are Psychological Malware

Let’s talk about LPs. Not the forward-thinking ones allocating into Digital Asset Treasuries or exploring composable yield. No, we mean the other ones. The LPs still trapped in an Excel-spreadsheet cosmology, running Monte Carlo simulations to feel something. The ones whose deepest emotional relationship is with their redemption clauses. These are the allocators who treat capital like it’s an anxious houseguest: let it stay for a bit, maybe make a few connections, and then kindly show it the door before things get too weird.

Redemption rights, vintage logic, quarterly expectations, these are not hallmarks of fiduciary discipline. They are artifacts of institutional anxiety. Psychological malware. Malware that has been polished, footnoted, and blessed by consultants who bill by the acronym. “Redemption risk” isn’t about protecting value. It’s about preserving the illusion of control. And it’s killing compounding before it even gets started.

Think about it: we’ve normalized entire capital structures around the idea that the best time to exit is the time everyone else is told to. That’s not strategy. That’s synchronized insecurity.

Redemption rights aren’t a safeguard. They’re a drag coefficient on conviction. They force decisions based on external schedules, not internal truths. And they let LPs feel like they’re “managing risk” when all they’re really doing is pulling the plug on upside to sleep better at night.

We need to stop pretending that allocating capital means knowing when to exit. That’s not investment. That’s timer-based anxiety coping. In the Infinite Fund, there is no exit. There is only flow. Composition. Recycling. Compounding. It’s not about timing markets. It’s about staying in sync with networks. It's less like a board meeting, and more like jazz, with a built-in yield curve.

And let’s be honest: half of these redemption terms are just set dressing for the institutional drama. It’s Game of Thrones with spreadsheets. People pretending that scheduling liquidity is the same thing as generating it. Meanwhile, capital that could be learning, reallocating, and compounding is instead sidelined so someone can hit an artificial IRR checkpoint to impress a committee that still thinks Web3 is a Wi-Fi setting.

The Infinite Fund model doesn’t fear redemption because it doesn’t build around fear. It builds around flow. There’s no point in allocating to emerging technologies if your capital structure is allergic to emergence. Redemption rights don’t protect. They constrict. They punish uncertainty when they should be fueling adaptation.

If capital is going to keep up with intelligent networks, it can’t be locked in a quarterly cage. It needs composability, not compliance theater. Let the money move. Let the models run. Let go of the idea that exits define value. In the Infinite Fund, value is what remains when exit pressure disappears.

Time Is Not a Constraint. It’s the Multiplier.

In the legacy model, time is a threat. A fuse. A bomb with a polite countdown clock and quarterly KPIs strapped to its side. Every fund review is a ticking ritual: How many years in? How many exits out? How can we explain this on a Zoom call without revealing that we have no idea what the protocol actually does? Time, in that world, isn’t capital’s ally. It’s its executioner.

But in our world, time is the multiplier. It’s the core primitive of compounding. The longer you stay in conviction, the longer your capital is allowed to learn, adapt, recycle, the more exponential the outcome. Not through blind HODL logic, but through dynamic alignment. You don’t beat the market by timing it. You beat it by syncing to its frequency and staying in flow.

Seneca doesn’t optimize for quarters. It doesn’t know what a quarter is. It doesn’t care when you bought in. It doesn’t need a narrative arc to justify its trades. What it wants is signal integrity, consistency across cycles. It holds, it flips, it reweights, it pauses. It does all of this without emotion, without pressure, and without the psychic weight of performance reviews or end-of-year letters to investors that sound like breakup emails.

This is not a portfolio manager with anxiety. This is capital intelligence on cruise control, with the ability to adapt to volatility regimes faster than any meat-based CIO ever could. No sleepless nights, no revenge trades, no “gut instinct” bets based on how someone felt after watching CNBC.

The difference is philosophical. In the Infinite Fund, time isn’t something you survive. It’s something you deploy. It’s not a risk to be hedged. It’s a lever to be pulled. The Infinite Fund doesn’t need to predict the future. It just needs to survive long enough to be right. That’s the game. That’s the edge.

And this isn’t a slow grind. It’s strategic velocity through coordination. When your assets are composable and your models are reactive, time stops being a wall and becomes a flywheel. We’re not talking about diamond hands. We’re talking about elastic capital that can flex across networks, cycle through yield layers, and keep going when everyone else is drawing down and writing Medium posts about the lessons they’ve learned.

To exit the timebox is to stop chasing alpha like it’s a loose dog and let it find you, through composability, signal awareness, and a structure that doesn't penalize patience. This is what capital looks like when it’s unshackled from the calendar. Time is not your enemy. Time is your algorithm.

Volatility Isn’t Risk. It’s Yield.

In Part 2, we’ll show why everything you were taught about volatility is backward. Legacy finance treats it like a threat, something to hedge, dampen, or escape. But in reality? Volatility is the fuel. It’s what creates the inefficiencies, the movements, the edges. It’s not the thing to fear. It’s the thing to harness.

We’ll take you deep into the operating logic of Digital Asset Treasuries like SBET and MSTR, and how strategies like Seneca extract yield from chaotic motion, not by calming it down, but by dancing with it. This isn’t risk avoidance. It’s risk orchestration. In the world of Infinite Funds, volatility isn’t a bug in the system. It’s the opportunity the system was built for.

You’ll see how capital becomes anti-fragile when it’s not locked into one path or one thesis. You’ll see how signal-aware models thrive in chaos, turning what once spooked the suits into consistent, composable return streams. The same volatility that sends the IRR crowd reaching for the antacids is exactly what fuels this new cycle of adaptive performance.

We’ll unpack how fear gets monetized, why risk isn’t the same thing as uncertainty, and how a properly designed Infinite Fund doesn’t just survive volatility, it drinks it for breakfast.

The clock is still the enemy. But signal? Signal is the future. And volatility is where that signal lives.

Explore More From Crypto Native: Digital Asset Reserves: From Gold to Bitcoin, Making Time Fungible, Liquid Startups: Instant Gratification Tokenized, and Rise of the AI Butler (Who Codes).

Web3 is changing the game: are you ready to invest smart? Explore tailored strategies and guidance at Nautilus.Finance. Stay updated in real-time by following Tom Serres on X.com or LinkedIn.

![crypto[native]](https://substackcdn.com/image/fetch/$s_!baju!,w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc94827b0-d403-4ff4-a1dc-b507623bbbd2_1000x1000.png)

![crypto[native]](https://substackcdn.com/image/fetch/$s_!baju!,w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc94827b0-d403-4ff4-a1dc-b507623bbbd2_1000x1000.png)